Our updated economic scenario

As we predicted in our 2018 outlook issue of Investor Insights, the year started on a strong footing. As time passes however, new trends emerge, and it is therefore time to update our economic scenario. In this issue, we focus on the US and the successes of ‘Trumponomics’, the divergence that is gaining ground between the old and the new continent, the situation in Italy, and finally the global environment.

‘Trumponomics’

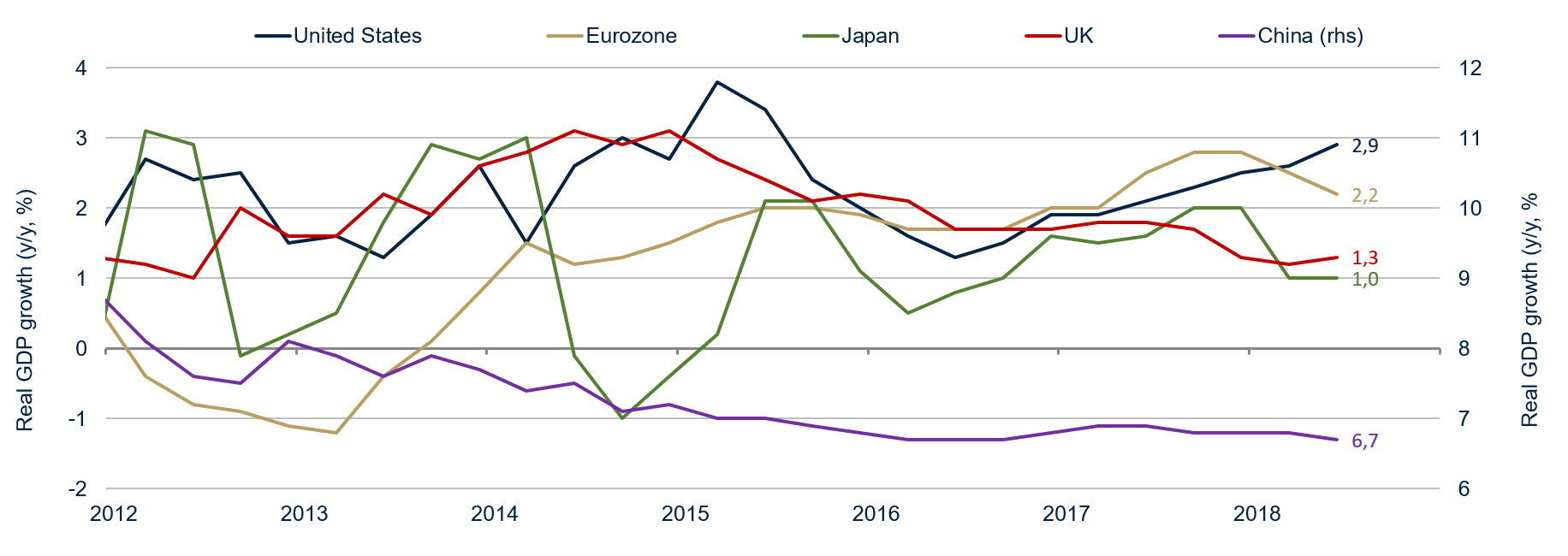

That 2018 started on a strong footing has subsequently been confirmed by many economic and financial market metrics. Among the major economies, the US one has been the most dynamic. As illustrated in figure 1, it has continuously gained momentum during the last two years while others have slowed. The idea of a synchronous business cycle that was in vogue in the first months of the year is now an inappropriate description. We believe this divergence in business cycle results directly from ‘Trumponomics’.

Figure 1: Synchronous and then divergent | Source: Bloomberg, ETHENEA

‘Trumponomics’ is, as you might imagine, the economic doctrine that President Trump follows. We can define it in two words: here and now.

‘Make America Great Again’ and ‘America First’ are the two leitmotifs that President Trump not only chanted during his campaign, but has also put into practice since he moved into the oval office in January 2017. This strategy consists of mortgaging the future, harvesting future economic growth dividends now, and repatriating the largest possible share of the global growth dividends here (into the country).

President Trump is mortgaging the future by stimulating the economy with an expansionary fiscal policy financed by government debt. The combination of tax reforms and fiscal spending is equivalent to an annual $300bn in additional spending over the next two years (a stimulus equivalent to 1.5% of GDP per annum). This is set to decline thereafter, but it will remain positive until 2028.

President Trump is repatriating global growth dividends – increasing US market share – by reshuffling the cards internationally; a strategy that only the world’s dominant economic, financial, political and military power can afford. As an example, he has threatened his country’s economic partners in North America (NAFTA), Europe and China by imposing tariffs in order to negotiate a deal more favourable to the United States at a later date. On the geopolitical front, he has also been active (Iran, North Kora, Israel…) and through this is showing the world his strength, a strategy designed to maximise US bargaining power¹.

Here and now is clearly a strategy for the short term. Debt-financed fiscal spending means high costs for future generations and a bigger market share does not mean a bigger pie tomorrow. There is no such thing as a free lunch, as the popular adage goes, meaning that there will also be a time for disillusionment.

Like it or not, ‘Trumponomics’ is currently successful! The figures speak for themselves. According to the Bloomberg Consensus, the GDP growth forecast for this year is 2.9% - the fastest growth since the Global Financial Crisis. At below 4%, unemployment is at a rate observed for only a few months in 2000 and in the late 1960s, in a word, rarely. Finally, new all-time highs in equity indices indicate that the current value of US firms has reached a new peak.

¹ A selection of 2018 (only) decisions and events bearing the imprint of President Trump make the here and now strategy clear. These include the Trump Tax Cuts and Jobs Acts, which entered into force on January 1; the relocation of the US embassy from Tel Aviv to Jerusalem announced on January 23; the Bipartisan Budget Act of 2018, approved on February 9; the imposition of US tariffs on Chinese imports on April 4; the US imposition of tariffs on imports of steel and aluminium from the European Union, Canada and Mexico on June 1; President Trump’s summit with the North Korean leader in Singapore on June 13; President Trump’s threat that the US could leave the NATO on July 12; sanctions against Iran were restored on August 6; and President Trump threatened to leave the WTO on August 31.

What is the view of the markets?

As investors, we are all interested in what financial markets price in and how we can position our portfolios accordingly.

Equity markets provide a simple answer to this question. With new all-time highs for the S&P 500, Nasdaq, and Russell indices, the majority of the equity markets are celebrating the successes of ‘Trumponomics’. Only the Dow Jones index is still a few percentage points below its all-time high.

The bond market shows some enthusiasm but not everywhere. For most of the year, the US 10-year government bond yield has remained just shy of the 3% level, while shorter-term yields have increased substantially in the wake of the Fed tightening cycle and forward guidance. In the context of the here and now strategy, the structure of the yield curve is upbeat regarding the short term, but doubtful regarding the long term. It tells us that in the 10 years to come, there will be a time to pay the piper.

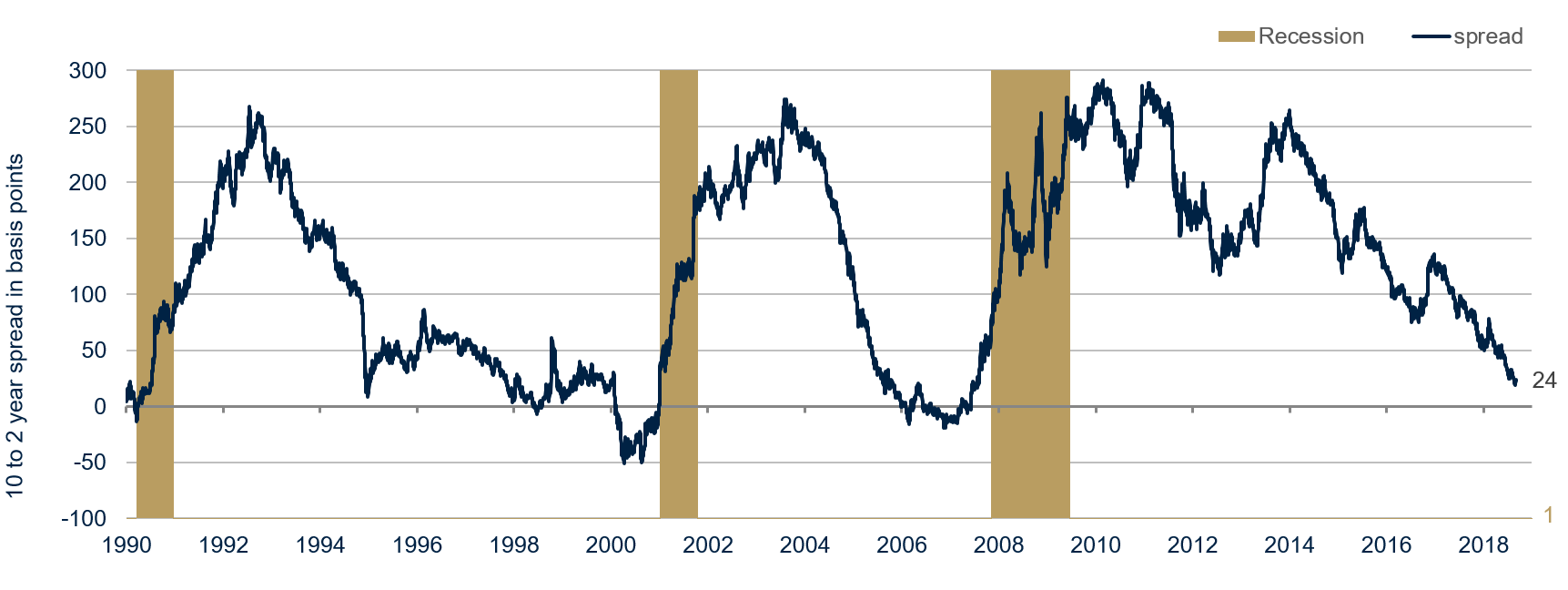

The flattening of the yield curve does not bode well for the future, as Guido Barthels wrote in his latest Market Commentary². When the spread between the long-term (10-year) and the short-term (2-year) yields becomes negative, the risk of a recession in the following 12 months increases substantially. As figure 2 shows, the narrowing of the spread already started in the Obama era but President Trump has been unable to reverse it.

Figure 2: The US yield curve is flattening | Source: Bloomberg, ETHENEA

‘Trumponomics’ is effectively only making cosmetic alterations to the current situation, but we are not seeing any long-lasting in-depth changes. This is the key message the yield curve conveys - a clear warning sign. This is an additional factor that reinforces our view that the US economy is in a late business cycle stage; and that President Trump’s economic success has delayed its end.

² Market Commentary, No. 9 ∙ September 2018

Meanwhile in Europe

In the eurozone, developments since the beginning of the year have been broadly in line with our main scenario. Despite slowing down, the eurozone economy has grown at a rate above potential growth. Consequently, unemployment has declined and inflation has modestly firmed up.

In the wake of this this overall good economic performance and still decent prospects, the ECB has decided to end its quantitative programme in December this year. The question of when there will be a first rate hike, probably in 2019, is open but recent ECB communications do not suggest any signs of urgency.

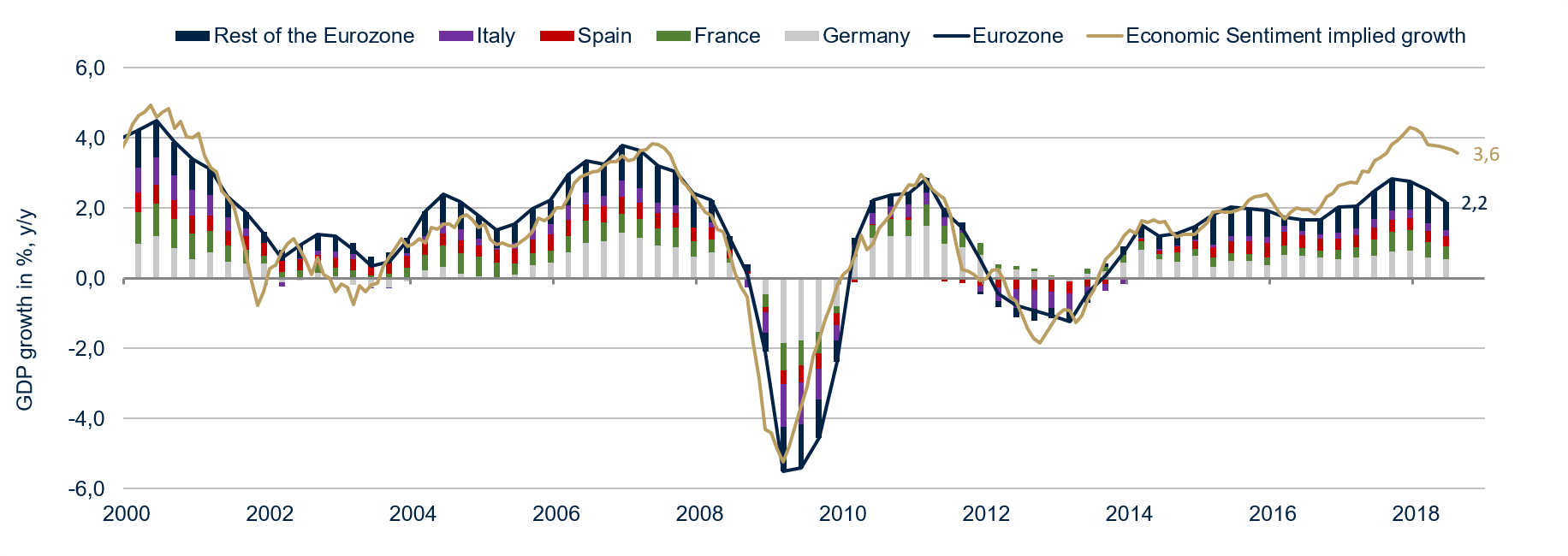

There is a general European growth slowdown, as figure 3 shows. France, Germany, Italy and Spain, the four biggest economies representing roughly 75% of the region’s GDP, have all lost momentum. The European Commission Business Sentiment indicator, which closely tracks growth development – also shown in figure 3 – signals that the slowdown is likely to continue.

Figure 3: Broad based slowdown in the Eurozone | Source: Bloomberg, ETHENEA

Against this backdrop, we believe that the eurozone economy is set to slow gradually in the coming quarters without raising concerns regarding monetary policy normalisation.

The stability of the eurozone depends on Italy

We have long argued that Italy is the number one systemic risk for the eurozone. The eurozone risk-free rate is not the German one – as Bunds are safe anyway – it is the Italian one. As long as Italian yields stay low enough that Italian government debt remains sustainable, the eurozone is safe and a new chapter of the euro crisis is unlikely to be written³.

Apart from Greece, the Italian economy is the worst in class in terms of growth. Figure 4 shows that the Italian GDP is still more than 5% below the level it reached 10 years ago (before the Global Financial Crisis) while the other three main economies (France, Germany and Spain), and the eurozone as a whole, have fully recovered. We are also not observing any signs that Italy is catching up.

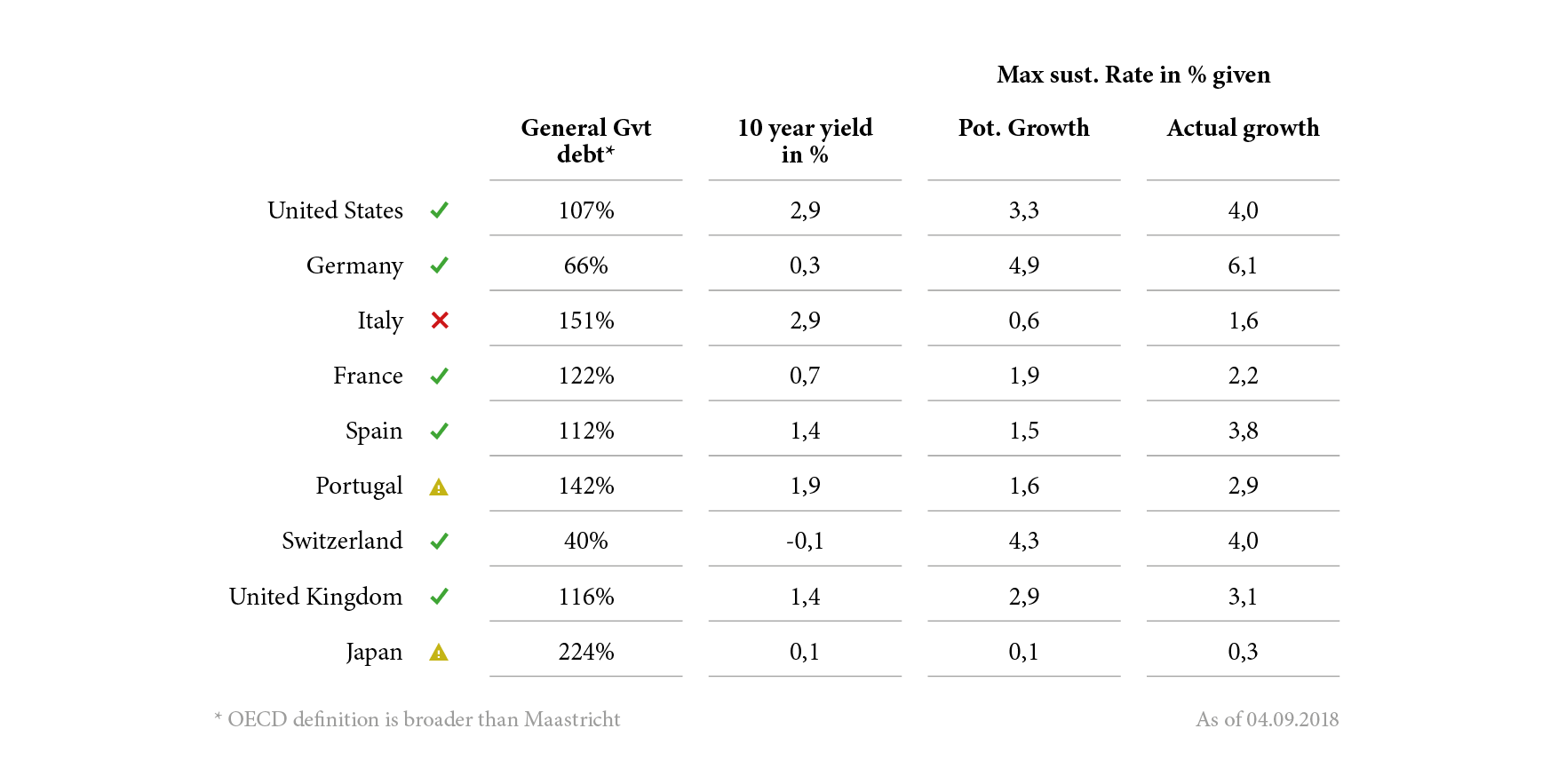

Figure 4: Italy is behind | Source: Bloomberg, ETHENEA

Currently, this country is operating under a heavy debt burden. We have updated our estimates of the maximum sustainable 10-year yield a government can afford and again find that Italian yields are sitting above this threshold⁴. According to OECD data, the Italian debt currently stands at 151% of GDP and, given estimates of potential GDP growth rate and actual growth rates, we derived the maximum sustainable affordable interest rate (figure 5). In Italy, it ranges between 0.6% and 1.6%, well below the current 2.9%. Italy is and remains in dangerous territory.

Figure 5: Estimates of maximum sustainable interest rate in the context of government finance | Source: Bloomberg, ETHENEA

Stuck between a structurally low growth environment and high indebtedness, the future of Italy depends fully on the level of interest rates and its capacity to refinance on markets. If interest rates were to remain too high for too long and the ability of the government to refinance were to evaporate, we believe that either the European Central Bank (ECB) and/or the European Stability Mechanism (ESM) – a European IMF – will step in.

We are not there yet. We recommend carefully monitoring developments in the peninsula and being very careful regarding investment in this county.

³ See Investor Insights Q4 2017

⁴ Interested readers are invited to read the Investor Insights Q2 2018 to get more details on the methodology used.

What about the global environment?

The slowdown observed in most of the countries (figure 1) mechanically transfers onto global growth. It is therefore not surprising that this has also slowed. However, in addition to the orderly loss of momentum we have described, developments in a few emerging markets have abruptly stopped. Among them, are Argentina, Brazil, India, Russia, Turkey, South Africa and Venezuela. While the reasons for their sudden stops vary, the result is that their currencies have all depreciated massively against the US dollar since the beginning of the year.

The good news is that no Asian country is featured on this list. However, it does not mean that these countries are immune, in particular when a trade war is raging between the world’s two biggest economies. Unfortunately, none of these developments bode well for global growth.

However, it is worth noting that China has engineered a controlled deleveraging of its economy that, although it has cost some growth, has strengthened the economic fundamentals there.

The global environment has become less favourable to growth and we already see the first downward revision in the Bloomberg consensus forecast. Nonetheless, according to this survey, global growth is expected to reach 3.7% in 2018 and 2019, still a good outlook.

Finally, global monetary policy conditions are becoming less supportive. The Fed is already reducing the size of its balance sheet at an increasing pace and, at the same time, it is hiking rates. Liquidity injections are also set to decline in Europe in the wake of the Asset Purchasing Programme tapering starting in October. Ten years after the collapse of the Investment bank Lehmann Brothers that thrust the world into the Global Financial Crisis and the Great Recessions (September 15, 2008), monetary conditions are slowly normalizing. What quantitative tightening and higher interest rates will ultimately imply for the world economy and financial markets is a question that no one can honestly answer. However, if you agree that quantitative easing and ultra-low interest rates have been supportive, quantitative tightening and higher interest rates must be restrictive.

Conclusion

According to our updated economic scenario, the US economy should continue to outperform the others, as ‘Trumponomics’ is in full swing. We nevertheless maintain our view that it is in a late business cycle stage, as the shape of the US yield curve reminds us. Overall, Europe is slowing and, more generally, global growth is losing momentum. Nevertheless, the outlook remains favourable enough for central banks to gradually reduce their monetary stimulus. Clouds are gathering and risks are tilted to the downside. Italy is weak and represents a systemic risk in Europe, fragile emerging markets have been hit hard, a trade war is raging, and monetary conditions are becoming more restrictive.

In this context, we find it appropriate to stay invested in equities and bonds, while at the same time favouring quality and liquidity. This is exactly what my Portfolio Management colleagues do on a daily basis.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

An investment in investment funds, as with all securities and comparable financial assets, carries the risk of capital or currency losses. The price of fund units and income levels will therefore fluctuate and cannot be guaranteed. The costs associated with fund investment affects the actual performance. Units are purchased solely on the basis of the statutory sales documentation (Key Investor Information, sales prospectuses and annual reports), which can be obtained free of charge in English from the fund management company ETHENEA Independent Investors S.A., 16 rue Gabriel Lippmann, L-5365 Munsbach, as well as from the Swiss representative: IPConcept (Schweiz) AG, In Gassen 6, Postfach, CH-8022 Zürich. The paying agent in Switzerland is DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich. All information published here constitutes a product description only. It does not constitute investment advice, an offer to enter into an agreement for the provision of advice or information or a solicitation of an offer to buy or sell securities. Contents have been carefully researched, compiled and checked. No guarantee for correctness, completeness or accuracy can be provided. Munsbach, 13.09.2018.