Interest rate turnaround or turning point?

The interest rate turnaround is on everybody’s lips – again. It’s not the first time that investors and savers have been preoccupied with a would-be interest rate turnaround. Interest rates and, in particular, yields on secure sovereign bonds spent decades steadily falling from their highs at the beginning of the 1980s to reach a historical low in the weeks around the end of 2008 and start of 2009 during the global financial crisis. Figure 1 shows that 10-year U.S. Treasury yields fell at this time to 2.04%. The benchmark yield on German 10-year Bunds reached its nadir on 15 January 2009 at the almost dizzying level (from today’s perspective) of 2.85%. At that time, nobody thought twice about the fact that the yield was positive!

Figure 1: Yields on 10-year U.S. Treasuries since 1962

In the years that followed, yields – especially in Germany – continually fell further as the euro crisis rumbled on until, in April 2015, the presumed no-go of 0% was almost within touching distance. At the 0.05% mark, however, the Bund yield obligingly turned upwards again. The Google Trends analysis of the search term “Zinswende” (interest rate turnaround) in Figure 2 shows that interest in this phenomenon soared for the first time as yields rose in 2015. But there was no sustained increase in interest rates or yields at that time, no more than when expectations of an interest rate turnaround re-emerged in Autumn 2017. Now here we go again for the third time.

Figure 2: Google Trends analysis of the search term “Zinswende” in Germany since 2004. https://trends.google.de/trends/explore?date=all&geo=DE&q=zinswende

Only time will tell whether the current (and third) attempt will be more successful than the previous two. While savers primarily want to earn interest on their savings again, many investors are fearful of a rise in interest rates. What a higher risk-free rate means to them is first and foremost valuation risk for their bond, equity, real estate and commodity investments. The question is, how real is this risk? Interest rates and, ultimately more importantly, longer-term yields and the aforementioned markets are linked at two main points:

(1) Relative attractiveness: Investors continuously compare the risk/return profiles of various investment alternatives. The higher the absolute returns of fixed-income securities, the more attractive they are perceived to be relative to the available alternatives.

(2) The fundamental valuation: All future income – be it coupons, rental income, dividends, profits, revenues or expected capital gains – must be discounted to determine the present value. The requisite discount rate is obtained by combining the risk-free rate with an individual risk premium for each asset. The higher the risk-free rate, the higher the discount factor and the lower the present value of the asset.

In our opinion, the effect of both factors is currently being overestimated in the market. While yields have risen of late and thus seem much more attractive than they were a year ago at first glance, high inflation is the main driver of this development at the moment. It’s also worth bearing in mind that bonds are nominal assets. That means than an investor gets a rate of interest that is fixed today, for example, for the next ten years (in the case of a German Bund, the rate of interest would be approx. 0.14% p.a. at 28 February 2022) and would then get back the amount they initially invested, let’s say EUR 100, in ten years’ time. At this point in time we cannot say what the real purchasing power of this investor’s EUR 100 would be in 2032. With inflation most recently at 5.1% in Germany and current market expectations for inflation at 2.1% per annum for the next ten years, however, the investor can expect a noticeable loss in purchasing power. In short, considering all relevant factors, including inflation expectations, nominal bond investments remain structurally unattractive relative to real assets such as equities, real estate and commodities.

In addition, the discount rate is not as significant either in theory or practice as generally believed. For one, the risk-free rate is generally much smaller than the risk premium. And moreover, neither analysts nor investors react to short-term changes in yields; they work with a smoothed average of historical yields and/or supplement this with their expectation for future yields. Furthermore, longer-term yields – such as those relevant for valuing assets without a fixed maturity date – are much less volatile than shorter-term rates, the reason being that knock-on effects have to be taken into account to a much greater extent. In the short term, for example, the rise in inflation can dictate a rise in yields. In the longer term, the probable economic dampener due to central banks’ efforts to combat inflation is already being factored into yields and is flattening out the fluctuations in the fair values of equities and real estate.

To the same extent that the interest rate turnaround is on everybody’s lips again, its effect on the markets is also being overestimated. Even an increase in the 10-year Bund yield to 1% or 2% – something that many people can hardly imagine at the moment – would not bring about a collapse in the fair value of equity markets according to analysts’ valuation models.

However, we can certainly talk of a turning point in capital markets at the moment, which will, at least for the next few years, change the face of the world of investment that equity investors have come to know and love since the global financial crisis. In this changed world, interest rates will be less of a factor than the fundamental stance of the key central banks and, in particular, the courses of action that will be open to them in the future. For context, and to aid understanding, it is helpful to cast a brief glance at the past. Until the global financial crisis of 2008/09, both the European Central Bank (and its national predecessors) and the U.S. Federal Reserve used the active management of the key rate as a core element of their monetary policy. Both institutions endeavoured to guarantee stable prices in this way¹. While maintaining financial stability and a secure banking system was also one of the functions of central banks, for a long time is wasn’t a pressing concern. This changed when the financial crisis happened, when quite a few people began to doubt that the global financial system would survive and the central banks had to contend with major upheaval. To deal with this, central banks took a great many extraordinary measures that, however, proved difficult to roll back once the acute phase of the crisis was over and henceforth became a fixture of the central banks’ toolbox. To distinguish them from the conventional measures that were used previously, these extraordinary measures initially intended as one-offs in time came to be widely referred to as unconventional measures.

In the years after the financial crisis, central banks took the sting out of many emerging economic problems using vast amounts of money. The new, expanded toolbox turned out to be a veritable box of tricks, and investors embraced it with open arms. Lightening-fast rallies on the heels of crises became the norm, and no problem seemed able to pose a serious threat. All the talk was about the Fed put, where the market believed central banks would step in when it came down to it and set prices rising again. There was a dangerous convergence in fiscal and monetary policy, even though many of the challenges were actually outside the remit of central banks and government financing by central banks is officially regarded as a strict no-no. So why was this possible for so long? Because it happened on the pretext of price stability. For years, inflation from Japan to Europe and onward to the U.S. was below the 2% target. Unconventional measures were supposed to help us get closer to the target of 2%. And then, so as not to have to give up too hastily the toolbox investors became so fond of in the event that the 2% mark was reached, fresh arguments kept being put forward (such as expected inflation should be locked in close to the 2% mark for subsequent years as well, if possible) or monetary policy objectives were expanded and relaxed. Thus, for instance, the Fed introduced average inflation targeting² in 2020 and the ECB also recently issued a new monetary policy strategy to be able to make more efficient use of unconventional measures in future if the situation arises.

This dream world of investment for investors, property owners and speculators could have remained intact if, after all these years and injections of money, inflation had not suddenly shot up to rates well above 2% last year. At first, it all seemed transitory, with no cause for urgency. Fed Chair Jerome Powell’s statement at a press conference in June 2020, “we’re not thinking about raising rates, we’re not even thinking about thinking about raising rates”, was much quoted. But we now live in a different world. While only in Autumn 2021 the first rate hike in the U.S. was not expected before 2023, of late expectations peaked at up to seven rate hikes for 2022 alone. Inflation has proved to be much more stubborn, higher and broader-based than expected for a long time. In addition, due to the labour and skills shortage, a spiral of rising prices and wages threatens to set in, which could cement inflation in the coming years at levels well above 2%. To make matters worse, there are some structural developments and extraordinary factors at play at the moment, over none of which central banks have any control, which argue against inflation returning to below 2% any time soon.

What investors can conclude from sustained high inflation combined with current full employment is simple, albeit hard to swallow: the lid on central banks’ box of tricks, which worked wonders for almost all asset classes over the past 13 years, will have to stay closed for the foreseeable future, and that means no more beloved Fed put. In these changing circumstances, central banks’ mandates simply no longer lend themselves to the generous supports of the past. Market participants will once more have to take the hit from setbacks in capital markets to a much greater extent. The next time there is a setback, the external lifeline that was the norm in recent times will not be there. This is a real turning point, which investors now have to get used to. No matter whether the interest rate turnaround ultimately comes to pass or is (again) delayed.

¹ The Fed is also explicitly pursuing maximum employment and moderate long-term interest rates as additional objectives on a par with stable prices. The ECB also subscribes to further comparable objectives, such as balanced economic growth and a highly competitive social market economy, provided they do not affect the goal of stable prices.

² As part of its long-term monetary policy strategy, the Fed introduced average inflation targeting in 2020. This strategy allows for inflation to rise and fall so that it averages 2% over the course of time.

Portfolio Manager Update & Fund positioning

Ethna-DEFENSIV

The world is holding its breath. Europe and the Western community of nations are looking eastward with sadness and grave concern. At the same time, investors are wondering what impact these fresh geopolitical tensions will have on their portfolios. The situation is extremely confusing at the moment and hard for outsiders to fathom. On the one hand, Russian leadership around Vladimir Putin seems willing to talk, but on the other, negotiations in recent weeks have clearly shown that Putin’s credibility leaves much to be desired and his diplomatic and military tactics can only be described as erratic.

With yields on 10-year sovereign bonds in the U.S. and Europe having steadily climbed in recent weeks, the flight of investors to safe havens put fresh pressure on sovereign yields. In mid-February, 10-year Bund yields peaked at over 0.30%. At the end of February, Bund yields closed at 0.19%. Risk premia for corporate bonds also continued to come under pressure, having already widened in recent weeks due to the expected tighter monetary policy. In Europe, investment grade corporate bond spreads over fail-safe government bonds were 138 basis points at the end of February, compared with 95 basis points at the beginning of the year. High-yield bonds were affected to an even greater extent; the spread at the end of February was 414 basis points, compared with 307 basis points at the start of January. As soon as the political situation is clearer, yields of more than 4% could absolutely present attractive entry points once again.

One thing is certain and that is the war in Ukraine will continue to dominate the headlines in the weeks to come and keep the capital markets in suspense. Uncertainty, and thus volatility, will remain high and tail risks with low probability but high impacts persist. At the moment, the top priority is capital preservation. We have been incrementally reducing fund risks since the beginning of the year. The equity allocation was reduced to zero early on and the spread risks on the corporate bond front was reduced by focusing on high-quality companies and selling riskier securities. As a result, the average bond portfolio rating markedly improved from between A- and A to between A and A+. Overall, the percentage of high-yield issuers is less than 15% and there are no corporate bonds with a rating of CCC- or less in the portfolio. This makes for a robust portfolio and stability, so the Ethna-DEFENSIV should continue to come through the geopolitical crisis in good shape. As an additional hedge, we increased the duration by purchasing a further 5% of U.S. Treasuries, and the U.S. dollar allocation was increased from just below 10% to 20%. Safe havens remain in demand due to the high level of uncertainty. The Ethna-DEFENSIV’s positioning thus remains conservative for the time being.

The fund lost 1.32% last month (T class). This is due to the aforementioned widening of spreads and the fact that EUR-denominated bond yields were higher than in the previous month. As expected, safe-haven asset classes were in strong demand, which led to an increase in the value of the U.S. dollar and helped fund performance. The longer duration was able to mitigate against the widening of spreads to some extent. For the year to date, the fund stands at -2.09% (T class). Given the current market situation, this can be regarded as an extremely positive interim result and goes to show the defensive nature of the fund.

Ethna-AKTIV

Last month was overshadowed by an escalation of the Ukraine conflict, which we, like so many, had considered highly unlikely. Financial markets, which had already been in correction mode, sped up the pricing in of any negative effects on the various asset classes. Equities, especially European stocks, fell sharply; the price of crude oil climbed to an eight-year high and the increase in interest rates anticipated by almost everybody paused. Although companies’ reports for the quarter and also the outlook statements were fundamentally positive last reporting season, it was clear that disappointments were punished disproportionately. However, at this point in time, the additional downside risk arising out of the conflict in Ukraine was not a known element. Sweeping sanctions and stronger pressure on commodity and energy prices will inevitably lead to weaker economic growth. The spectre of stagflation will mean that governments and central banks will have to carefully rethink their plans for returning to normality, even though the situation in the individual regions is very different. The fact is that the risks in the short- and medium-term have ballooned, and we therefore believe that a more defensive fund positioning is justified.

We took action to implement this successively last month. As well as the incremental reduction in the equity allocation by selling index futures, we increased the USD allocation – both physically and via options – to over 40%. Finally, the interest-rate sensitivity of the fund was increased back up to over 4 by purchasing sovereign bonds and closing the duration hedge. We were thus able to greatly limit fund losses over the course of the month.

For us to take on more risk again going forward, we need either a clearer picture of the economic impacts of the Ukraine conflict as well as potential adjustments in fiscal and monetary policy or a very sharp correction allowing us effectively to purchase at prices that give us a cushion. A glance at the broader picture of valuations shows that not much of last year’s excesses has been worked off as yet. Still, sharp countermovements can happen time and again, and we saw this in the last few days of trading in February. It is important not to see these as the start of a new bull market and chase short-term price movements. Therefore, in this market phase in particular, it is important to stay away from volatility in the market and prioritise capital preservation by making fewer trades and having a balanced defensive portfolio. This means we remain able to act and take opportunities again with the Ethna-AKTIV over the further course of the year.

Ethna-DYNAMISCH

February brought with it a geopolitical escalation of the Russia-Ukraine conflict that probably only a very few people could have imagined just a short time ago. In capital markets too, this has been the top issue in recent days, relegating other issues to the background. The escalation has meant the state of affairs has become a great deal more complex. In particular, in the commodities and energy sectors, Russia is closely linked to the global economy. Rising prices and shortages are likely to further stoke up inflation worldwide and keep it high, while, specifically in Europe, not only the immediate threat of war but above all rising energy costs could turn into an increasingly strong economic dampener. In light of the ongoing (if not growing) inflation risks and the (almost too) good employment situation in the labour market, no strong support from central banks can be expected in capital markets for the foreseeable future (see also our comments in the main body of the Market Commentary above). This has hit and is hitting the markets in what is already a tense situation, as we mentioned in last month’s Market Commentary. On top of the known valuation risks in individual growth segments of equity markets, growth risks were now increasing, which may put pressure on more cyclical business models.

Against this backdrop, equity markets pressed the pause button on the much-discussed rotation out of growth and into value equities in February, while the broad indices tended to rack up further losses. The bond markets were also dominated by price losses, as both sovereign bond yields and spreads for corporate bonds increased further. Only gold was able to shine in this environment.

Despite, and because of, the imponderables in the general environment, select equities with maximally solid and promising business models remain the strategic focus of the Ethna-DYNAMISCH. Before the situation in Ukraine escalated, we had further expanded the hedging components in the fund at the beginning of February and reduced the net equity allocation – which had already been successively reduced over the previous months – to just under 50%. Neither in the fund nor within the portfolio companies are there significant direct points of contact with Russia and the border regions affected. One exception to this is the Spanish clothing giant Inditex, which generates around 5% of its revenue in Russia with brands such as Zara and Massimo Dutti. After an almost 20% decline in the share price year-to-date, we believe the risks to be priced into the industry leader’s price and added to the position at the end of February. In the case of Chinese holding company Alibaba, which focuses on online retail, we have also long considered many corporate risks to be priced in. However, recent events in Russia again brought it home to us that the political risk in unfree states is unpredictable when it comes down to it and can overshadow the business opportunities for a long time. Since the pipeline of attractive investment candidates is filling up given the current market weakness, we sold Alibaba in its entirety over the course of the month.

On the other side of the ledger from the current slimmed-down equity portfolio in the Ethna-DYNAMISCH there is a very high cash position at the moment, with around 20% directly in cash, 16% in short-dated AAA bonds as a cash substitute and slightly more than 10% in synthetic cash via equity hedges (difference between gross and net equity allocation). Against the backdrop of structurally rising interest rates and widening spreads of late, traditional bonds remain absent from the portfolio. The overall rather defensive positioning of the equity-focused multi-asset fund is rounded off with a small, 3% position in gold.

HESPER FUND - Global Solutions (*)

Equity markets that were already under pressure from robust inflation and tighter monetary policies worldwide plummeted in February in the face of the Russian invasion of Ukraine and the escalation of the resulting sanctions. Global markets are now facing a new high-risk, unclear scenario, that combines a geopolitical shock with a challenging macroeconomic environment. The Russian attack on Ukraine shook global markets and propelled the prices of a whole range of commodities, from energy to wheat and aluminium, to new highs. Energy prices soared, exacerbating the already difficult inflationary outlook. On the other hand, safe haven assets, such as US Treasuries and other secure sovereign bonds, gold, the Swiss franc, the Japanese yen and the US dollar benefitted.

The conflict in Ukraine represents a major negative supply and demand shock, just as the global economy was attempting to recover from the Covid-19 pandemic. Higher inflation and slower growth are on the horizon, raising the spectre of stagflation, particularly in hard-hit Europe, which is heavily dependent on Russian gas and oil. Growth fears and the search for safe haven assets have halted the increase in sovereign bond yields, while spreads have widened. Market expectations about tighter central bank monetary policy have been recalibrated. Even fiscal policy may become more accommodative in order to support households and companies in overcoming the jump in energy costs.

The US stock markets extended their losses in February. The S&P 500 plunged by 3.1% and the Dow Jones lost 3.5%. The Nasdaq Composite fell by 3.4%. High volatility and intense rotation were the hallmarks of another difficult month.

In Europe, stock markets suffered the most. The large cap Euro Stoxx 50 Index lost 6% (a decrease of 6.1% when calculated in USD), while in the UK, the FTSE 100 decreased by 0.1% (-0.4%% in USD). The defensive Swiss Market Index fell by 2% (-0.7% in dollar terms) over the month.

Asian markets held up well in light of the armed conflict in Europe, with the Shanghai Shenzhen CSI 300 Index gaining 0.4% (+1.2% in USD terms). In Japan, the blue-chip Nikkei 225 dropped by1.8% (-1.8% in USD terms). The Korean market rebounded from the heavy losses in January, as the KOSPI Index rose by 1.3% (+2% in dollar terms). In contrast, the Hang Seng Index in Hong Kong plunged by 4.6%

The conflict in Ukraine poses serious challenges to the HESPER FUND – Global Solutions’ macro scenario for 2022. Solid global growth and inflation slowly reverting to central bank targets are at significant risk in an environment of decisively tighter monetary policies. The economic and financial isolation of Russia - a major hub for the supply of energy and raw materials - and its effect on inflation and international trade represent a considerable challenge for global growth. Policymakers who were just starting to withdraw their extraordinary pandemic support, now need to carefully reassess their normalisation plans. Unfortunately, in a range of ways this is likely to be a long-lasting conflict, the effects of which may well be felt for years to come. But the most important issue has already been decided. The last few days have proved to the entire world that the Ukrainians do not want to live under a new Russian empire. The only open question is how long it will take for this message to penetrate the Kremlin’s thick walls.

The path for a soft landing for the major advanced economies in 2023 is still open but is becoming narrower and more uncertain by the day. Inflationary risks are tilted to the upside and, with growth softening further due to the conflict in Ukraine, central banks face even tougher trade-offs between growth and employment.

In February, the fund managed to preserve capital under very difficult conditions. To a certain extent, currencies and commodities helped to cushion the selloff in equities and the wild swings in fixed income positions. The main changes during the month were a rebalancing of the ETF equity indices in favour of non-European markets, further currency diversification out of the eurozone, and a slight increase in duration.

As we are heading into the new month, the fund is retaining a very cautious stance. Net equity exposure is at 20%, sovereign bonds are at 18%, high yield corporate bonds have a 12% allocation, corporate investment grade bonds have 9%, commodities have 7% and gold has 6%. On the currency front, the HESPER FUND – Global Solutions has the following exposure: 37% to the US dollar, 15% to the Swiss franc, 10% to the Canadian dollar, 2% to the Brazilian real and 1.5% the Norwegian krone. In addition, it is short 20% against the British pound.

As always, we continue to monitor and calibrate the fund’s exposure to the various asset classes on an ongoing basis to adapt to market sentiment and changes in the macroeconomic baseline scenario. At the moment, the war in Ukraine is eclipsing current economic conditions and data flow as the main metric.

In February, the HESPER FUND - Global Solutions EUR T-6 decreased by 0.10%. YTD the Fund is at -2.68%. Volatility for the last 250 days has fallen to 6.58%, retaining an interesting risk/return profile. The annualised return since inception is at 7.04%.

*The HESPER FUND – Global Solutions is currently only authorised for distribution in Germany, Luxembourg, Italy, France, and Switzerland.

Figure 3: Portfolio structure* of the Ethna-DEFENSIV

Figure 4: Portfolio structure* of the Ethna-AKTIV

Figure 5: Portfolio structure* of the Ethna-DYNAMISCH

Figure 6: Portfolio composition of the Ethna-DEFENSIV by currency

Figure 7: Portfolio composition of the Ethna-AKTIV by currency

Figure 8: Portfolio composition of the Ethna-DYNAMISCH by currency

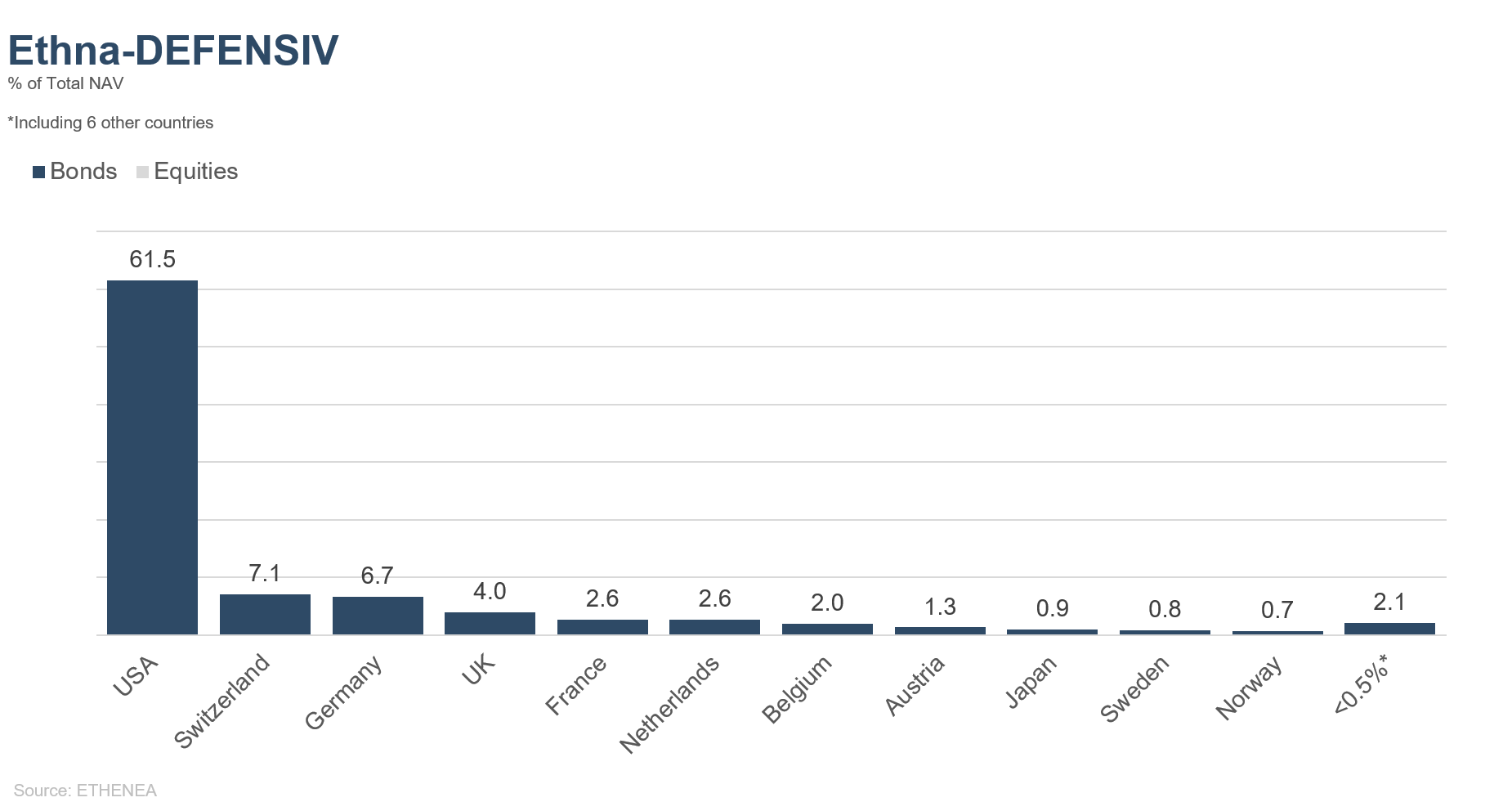

Figure 9: Portfolio composition of the Ethna-DEFENSIV by country

Figure 10: Portfolio composition of the Ethna-AKTIV by country

Figure 11: Portfolio composition of the Ethna-DYNAMISCH by country

Figure 12: Portfolio composition of the Ethna-DEFENSIV by issuer sector

Figure 13: Portfolio composition of the Ethna-AKTIV by issuer sector

Figure 14: Portfolio composition of the Ethna-DYNAMISCH by issuer sector

* “Cash” comprises term deposits, call money and current accounts/other accounts. “Equities net” comprises direct investments and exposure resulting from equity derivatives.

Please contact us at any time if you have questions or suggestions.

ETHENEA Independent Investors S.A.

16, rue Gabriel Lippmann · 5365 Munsbach

Phone +352 276 921-0 · Fax +352 276 921-1099

info@ethenea.com · ethenea.com

La presente es una comunicación promocional. Tiene exclusivamente para transmitir información del producto y no constituye un documento exigido por la ley o la normativa. La información incluida en el presente documento no representa una solicitud, oferta o recomendación para comprar o vender acciones del fondo o para realizar cualquier otra transacción. Su objetivo no es otro que ayudar al lector a entender las características principales del fondo como, por ejemplo, el proceso de inversión y no pretende ser, en todo o en parte, una recomendación de inversión. No sustituye a su propia consideración ni a otra información y asesoramiento de carácter legal, fiscal o financiero. Ni la sociedad gestora ni sus empleados u órganos podrán ser considerados responsables de las pérdidas incurridas, directa o indirectamente, por el uso del contenido del presente documento o en relación con este. Los documentos de venta actualmente vigentes en alemán (folleto, documentos de datos fundamentales (PRIIPs-KIDs), junto con los informes anual y semestral), en los que figura información detallada sobre la suscripción del fondo y los riesgos y las oportunidades y riesgos relacionados, constituyen la única base vinculante para la suscripción de acciones. Los mencionados documentos de venta en alemán (así como sus versiones no oficiales traducidas a otros idiomas) pueden consultarse en www.ethenea.com y obtenerse de forma gratuita en la sociedad gestora, ETHENEA Independent Investors S.A. y el depositario, así como en los respectivos agentes de pago o de información de cada país y el representante en Suiza. Los agentes de pago o de información son los siguientes para los fondos Ethna-AKTIV, Ethna-DEFENSIV y Ethna-DYNAMISCH: Alemania, Austria, Bélgica, Liechtenstein, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; España: ALLFUNDS BANK, S.A., C/ Estafeta, 6 (la Moraleja), Edificio 3 – Complejo Plaza de la Fuente, ES-28109 Alcobendas (Madrid); Francia: CACEIS Bank France, 1-3 place Valhubert, F-75013 Paris; Italia: State Street Bank International – Succursale Italia, Via Ferrante Aporti, 10, IT-20125 Milano; Société Génerale Securities Services, Via Benigno Crespi, 19/A - MAC 2, IT-20123 Milano; Banca Sella Holding S.p.A., Piazza Gaudenzio Sella 1, IT-13900 Biella; Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. Los agentes de pago o de información son los siguientes para HESPER FUND, SICAV - Global Solutions: Alemania, Austria, Bélgica, Francia, Luxemburgo: DZ PRIVATBANK S.A., 4, rue Thomas Edison, L-1445 Strassen, Luxemburgo; Italia: Allfunds Bank S.A.U – Succursale di Milano, Via Bocchetto 6, IT-20123 Milano; Suiza: Representante: IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zürich; Agente de pagos: DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zürich. La sociedad gestora podrá rescindir los acuerdos de distribución vigentes con terceros o retirar los permisos de distribución por razones estratégicas o exigidas por ley, respetando los plazos. Los inversores pueden obtener información sobre sus derechos en el sitio web www.ethenea.com y en el folleto. La información se encuentra disponible en alemán e inglés y, en ciertos casos, también otros idiomas. Creado por: ETHENEA Independent Investors S.A. Se prohíbe transmitir el presente documento a personas domiciliadas en países en los que la distribución del fondo no está permitida o en los que se requiere autorización para su distribución. Las acciones únicamente podrán ofrecerse a personas de dichos países si la oferta cumple con las disposiciones legales aplicables y se garantiza que la distribución y publicación del presente documento, así como la oferta o venta de acciones, no están sujetas a ninguna restricción en la jurisdicción en cuestión. En particular, el fondo no se ofrece ni en Estados Unidos de América ni a personas estadounidenses (en el sentido de la norma 902 del Reglamento S de la Ley de valores de EE. UU. de 1933, en su versión vigente) ni a personas que actúen en representación, por cuenta o en beneficio de una persona estadounidense. La rentabilidad histórica no debe considerarse una indicación o garantía de la rentabilidad futura. Las fluctuaciones del valor de los instrumentos financieros subyacentes, sus rendimientos y las variaciones de los tipos de interés y los tipos de cambio implican que el valor de las acciones de un fondo y los rendimientos que de ellas se derivan pueden incrementarse o disminuir, y no están garantizados. Las valoraciones incluidas en el presente documento se basan en varios factores, entre los que cabe incluir los precios actuales, la estimación del valor de los activos subyacentes y la liquidez del mercado, así como otros supuestos e información disponible al público. En general, los precios, los valores y los rendimientos pueden incrementarse o disminuir, hasta la pérdida total del capital invertido, y los supuestos y la información pueden cambiar sin previo aviso. El valor del capital invertido o el precio de las acciones del fondo, así como los rendimientos y los importes de reparto derivados de este, pueden oscilar o quedar totalmente anulados. Por tanto, una rentabilidad histórica positiva (revalorización) no constituye una garantía de una rentabilidad positiva en el futuro. En particular, no puede garantizarse la preservación del capital invertido, por lo que, en caso de venta o reembolso, no se garantiza que el valor del capital invertido o de las acciones mantenidas en el fondo se corresponderá con el capital invertido inicialmente. Las inversiones en divisas están sujetas a fluctuaciones adicionales del tipo de cambio o riesgos cambiarios, es decir, la rentabilidad de dichas inversiones depende también de la volatilidad de la divisa, lo que puede incidir de forma negativa en el valor del capital invertido. Las posiciones y asignaciones pueden variar. En el cálculo se incluyen las comisiones de gestión y custodia, así como todos los demás gastos aplicados al fondo según lo estipulado en el contrato. El cálculo de la rentabilidad se basa en método BVI, es decir, no incluye la comisión de venta, los costes de transacción (como las comisiones de órdenes e intermediación) ni las comisiones de custodia y otros gastos de gestión. El resultado de la inversión sería inferior si se tuviese en cuenta la comisión de venta. No puede garantizarse que las previsiones del mercado vayan a cumplirse. Cualquier alusión a los riesgos en esta publicación no debe considerarse que constituye la divulgación de todos los riesgos o la gestión definitiva de los riesgos mencionados. En el folleto figura la descripción detallada expresa de los riesgos. No puede garantizarse la exactitud, integridad o vigencia. El contenido y la información están sujetos a la protección de los derechos de autor. No puede garantizarse que el documento cumpla todos los requisitos legales o reglamentarios estipulados para él en países distintos a Luxemburgo. Nota: los términos técnicos más importantes pueden consultarse en el glosario que figura en www.ethenea.com/glossar. Información para los inversores en Suiza: El país de origen de la institución de inversión colectiva es Luxemburgo. El representante en Suiza es IPConcept (Schweiz) AG, Münsterhof 12, Postfach, CH-8022 Zúrich. El agente de pagos en Suiza es DZ PRIVATBANK (Schweiz) AG, Münsterhof 12, CH-8022 Zúrich. El folleto, los documentos de datos fundamentales (PRIIPs-KIDs), los estatutos y los informes anual y semestral pueden obtenerse de forma gratuita a través del representante. Copyright © ETHENEA Independent Investors S.A. (2025) Todos los derechos reservados. 02-03-2022